Executive summary:

Nongfu Shanquan is a Chinese Beverage Behemoth, with a presence in bottled water, ready-to-drink (RTD) beverages, energy drinks and juices. Below is their latest revenue and operating profit breakdown in FY2024.

Source: Company Financials, Author Calculations

The company possesses strong competitive advantages in its brand name, spring water assets, proprietary tea technology and scaled distribution network. Recently, the business has faced temporary setbacks, including a publicity scandal and a price war. However, the prospects are bright for those who seek to own a quality business for the long term. Nongfu’s competitive advantages will support continued share gains in new and existing categories in the water business, which differs from the consensus view of growth rates reverting closer to the overall industry. Coupled with tailwinds in the Ready to Drink (RTD) tea and RTD sugar-free tea categories, I expect the company’s top line and bottom line to compound at rates higher than the industry for far longer.

I also learnt more about some industry and business-specific information and verified current narratives about the company through an expert call with an industry insider who has over 2 decades of experience in China's beverage industry. The insider has been at Nongfu since 2019 and previously worked for Coca-Cola. He is currently a regional director in the North-East of China focused on sales and distribution.

Section 1: Competitive Advantages:

Nongfu Spring has 4 main competitive advantages that other large competitors cannot replicate.

Fixed assets are a cornered resource:

Firstly, Nongfu's main fixed assets, its natural water springs, are a cornered resource.

Source: Nongfu Shanquan IPO prospectus

It is very difficult for competitors to replicate these one-of-a-kind assets. Even if they gained control of a similar asset, getting the necessary permitting and bringing it to production takes a similar time to that of a resource mine, almost a decade. These cornered resources are also strategically positioned well to support Nongfu’s distribution network, based on the 500 km rule, where past this distance, the company cannot cover its transportation costs at the current retail pricing level of 2 RMB per 500ml bottle of water.

Intangible Assets in its brand name:

Nongfu’s fixed assets underpin their other moat, their brand. Nongfu has built a strong brand image of healthy natural water around its water sources. While the slogans and marketing methods have evolved, the core message is the same, and customers view Nongfu as differentiated compared to peers who use the municipal water supply. Nongfu’s brand strength allows for lower spending on marketing than peers, which is currently at 4% of revenues, while its closest competitor China Resource Beverage (CRB)spends 8% of revenues on marketing.

Proprietary technology in its RTD Tea products:

Nongfu’s RTD tea products have a leading market share of 70% in China. The tea products have superior taste, as they utilize specialised machinery which retains the taste and aroma of the tea leaves. A key sign of the tea’s quality is that the taste doesn't change regardless of its temperature. Most bottled teas are not able to be enjoyed hot, but Nongfu’s tea is. This technology is difficult to replicate because the machinery used is specialised. It is currently difficult for competitors to acquire them due to their current high costs. There is also a need to develop human capital with the know-how to operate the machinery optimally. From the insider interview, I learnt that it takes 3-5 years for Nongfu to fully master the process, meaning that there is a considerable advantage over peers who seek to effectively compete with Nongfu in Tea. The evidence that Japanese tea manufacturing technology is a big advantage is that. In the Tea Market in China, the second largest player in both RTD Tea and RTD Sugar-Free Tea is the Japanese Brand Suntory at around 12%.

Strong entrenched relationships with distributors and suppliers:

On the distribution side, Nongfu has a strong network set apart by their incentive-based agreements with their distributors. Nongfu sets minimum annual sales targets and necessary marketing budgets with their distributors, rewarding them with more autonomy and profits as they sell more, resulting in a virtuous cycle which encourages them to sell more Nongfu products, enhancing cross-selling of further categories. Ultimately, this results in distributors being more reliant on Nongfu, further entrenching the relationship and fostering goodwill.

Meanwhile, on the procurement side, Nongfu fosters good relationships with its suppliers, likely choosing a concentrated supplier base to enjoy larger bulk purchase benefits of raw materials, mainly PET for making plastic bottles. On a group level, PET constitutes about a quarter of COGS. Nongfu’s five largest suppliers for raw materials in terms of purchase volume account for about 40% of their total purchases, with four of the five suppliers being suppliers of PET. Compared to CRB, Nongfu PET costs as a percentage of total COGS is about 100 BPS lower and this makes sense given CRB’s top 5 suppliers account for around 30% of total purchases compared to Nongfu’s 40%.

With a more concentrated supplier base, Nongfu needs to foster goodwill with these suppliers in the event of supply shocks. That is why their payable days are much higher than their peers, leading to a positive cash conversion cycle. While doing so might not maximise cash flow potential, it makes the business far more resilient.

Source: Company Filings, author calculations

This relationship moat might seem easy to replicate, but competitors are less likely to want to give up on their juicy cash flow cycles and give up further profits in exchange for a deepened relationship with distributors. Hence, this cultural advantage is something unique that Nongfu possesses.

These moats have protected the business’ high ROIC:

Overall, these competitive advantages have allowed Nongfu to earn ROIC well above its cost of capital sustainably since 2017.

Source: Company financials, author calculations

Let’s also consider the direction of the moat. With stiff competition in beverages, is Nongfu’s moat shrinking or widening From the ROIIC figures which consider the incremental capital that is invested, Nongfu’s moat is widening as ROIIC is generally trending upwards since 2017.

Section 2: Investment Theses

Thesis 1: Nongfu’s recent market share losses in the water segment are largely driven by short-term factors. In the long term, the business can continue to gain market share and grow above industry averages.

When it rains, it pours, explaining what the short-term headwinds are:

In 2024, Nongfu was hit by a storm of controversies. This included:

Angry netizens, spurred by the death of the Wahaha founder, accused Nongfu’s founder and CEO of not being patriotic. This spiralled into accusations of product design being pro-Japanese.

Consensus and industry watchers believed Nongfu botched the launch of its new purified water product through aggressive pricing.

Hong Kong consumer watchdog launched an investigation into the bromate content of Nongfu’s water.

Overall, this resulted in a 21% fall in revenues for Nongfu’s water segment in FY2024, and group net income growth being flat.

I also believe there has been an overreaction to the market share losses. Despite Nongfu losing about 7% market share and the top spot for market share in a short time, most of Nongfu’s share losses were gained by Wahaha, rather than C'est Bon, which is a much larger threat. As Nongfu has begun to regain market share with the recovery of consumer image, Wahaha’s gains have stalled and been regained by Nongfu.

Green shoots and my differentiated view:

The PR fiasco has started to abate as the CEO has gone on a publicity campaign, with airings on state television portraying the company favourably. The Hong Kong consumer watchdog has come out and apologised for the inaccurate information about Nongfu’s water safety. As seen below, Nongfu’s negative public opinion peaked in March 2024 and then came down.

Source: Baiguan bigonelab

In the short term, lapping easy comps, consensus expects 14% growth in the water segment, which implies a return to previous market share levels of about 23% in the next 1-2 years.

In the long run, while consensus predicts that growth will return to a level closer to the industry’s of around 7-8% once market share has been recovered, I believe that the growth rate of the water business will revert to industry levels more slowly, and remain at the high single-digit range for the next 5 years, driven by market share gains against smaller players.

Post 2025 recovery, I project market share gains to contribute an additional 200-300 bps of volume growth, resulting in 2-3% higher projected annual revenue growth than consensus. This will amount to Nongfu’s market share reaching about 30-35% market share in the next 10 years, driven by further consolidation.

Source: Nongfu Shanquan IPO prospectus

Even though the market is already consolidated as seen above in 2019, this is still realistic when benchmarked against the company’s internal goal of 50% market share.

I believe the water business will consolidate further due to long-term structural factors, including the ability to capture economies of scale and increasing costs of quality control. Another key factor is that suppliers and distributors are cautious from the unfavourable consumer environment, and want to work with the top players to guarantee their success and reduce risk. This is especially pertinent for Nongfu, which enjoys the best reputation among distributors. Our call with the expert revealed that working with Nongfu is seen as a risk-free endeavour, especially in an environment where other investments like stocks and real estate are not doing so well. In other words, a distribution partnership with Nongfu is almost like owning a McDonald's franchise, one is willing to give up more to own a franchise due to a higher likelihood of success.

How Nongfu’s entrance into purified water complements its market share gains:

Nongfu’s purified water (green) and Natural Water (red). Source: Dao Insights

Nongfu’s foray into purified water and the price war is seen by industry observers to be a mistake. After all, Nongfu’s original identity is in natural spring water, their main product. However, having its own purified water product further separates Nongfu’s Natural Water from the purified water category where most of its peers are, reducing the substitutability of its main Natural Water product and protecting it from price competition. Most customers currently see Nongfu’s red natural water product and the purified water products of competitors to be direct substitutes, as they are generally priced in the 2 RMB range for the 500ml bottle.

The insider also mentioned that another reason for entering purified water is that Nongfu employs a targeted expansion strategy against smaller players, choosing regions where smaller players have more presence to gain market share. In the past, Nongfu used to lower the prices of their red natural water to gain market share aggressively in these markets.

Hence, the purified water product, which is slightly cheaper than the natural water product, can serve the purpose of acting as a beachhead into these markets, but also protect Nongfu’s natural water product against other big players who are trying to do the same thing. When a big competitor like CRB follows Nongfu into these markets, they are going up against Nongfu’s purified water product, rather than their core natural water product. (Certainly helps that CRB, their largest competitor, also uses green packaging for their Cest’bon purified water as seen below)

Source: South China Morning Post

This puts into perspective the recent price war with the purified water product, which lasted for about 9 months. The price war was done to allow their new product to gain mindshare and initial market share. Using such a strategy is not new for Nongfu, just that doing it on a national scale with purified water increased the negative impact. In the future, Nongfu will return to using pricing as part of a targeted expansion strategy, rather than a full-scale price war.

This strategic expansion into purified water is backed by its economic moats:

Backed by its moat of natural water sources and intangible brand assets, both Nongfu’s purified and natural water products have product differentiation from other purified water brands. Nongfu’s cornered resources also mean that its competitors cannot expand their market and compete through expansion in the natural water category as they lack the best natural water spring assets.

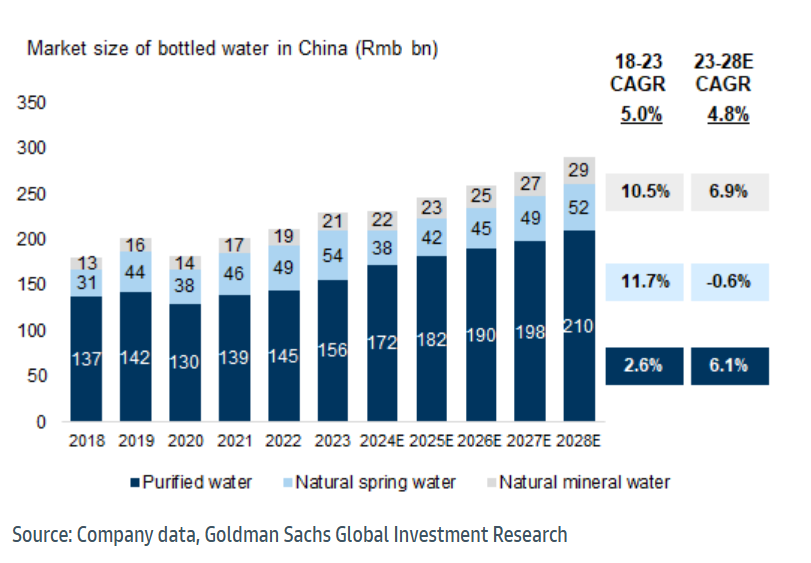

Source: Goldman Sachs

While some predict slower growth of the natural water industry due to the availability of water sources through competitors gaining access to the other natural water assets, I believe that Nongfu has control of the best assets due to the first-mover advantage in many regions. The projections by competitor CRB below actually predict a much stronger growth trajectory for natural water, which is likely what falls in the ‘other category’.

Source: China Resource Beverage IPO Prospectus

First-mover advantage is very important in attaining these water sources. For example, the industry insider mentioned that Nongfu themselves cannot dislodge some entrenched local players like Quanyangquan in Jilin, as their strong natural water assets have built a brand identity and advantageous cost structures.

Lastly, Nongfu has the advantage of optimal Point of Sale (POS) exposure in rural and lower tier cities, which helps to drive volume gains from increased market share and category growth. This is evidenced by 80% of Nongfu’s POS being lower-tier cities. It is necessary to work with smaller sub-distributors in these areas, and so Nongfu opts for a more direct relationship with them in these markets.

Source: Goldman Sachs

Considering costs of implementation and synergies:

Entering into the purified water market does not require a lot of additional investment by Nongfu. The main investments needed are equipment to conduct reverse osmosis, and the additional step required to convert their spring water into purified water. Other than that, the entrance into the purified water market can rely on existing infrastructure, such as logistics, warehouse storage, distribution and advertising.

Thesis 2: Nongfu’s exposure to tea, juices, and energy drinks both drives growth and offers diversification against temporary water market share losses, making it more attractive than other beverage competitors who are more concentrated. Of the non-water categories, Tea is the most important.

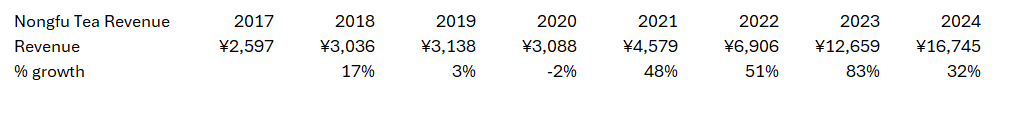

Amidst Nongfu's water troubles, the Ready to Drink (RTD) tea category has shined this year, and also in the past 5 years, with staggering growth.

Source: Company financials

The Tea beverage market's fast growth and separation from the bottled water brand allowed Nongfu to remain resilient. When the controversies about Nongfu’s water spilt over into the tea business and netizens accused Nongfu of being unpatriotic, the tea business largely remained unaffected. Nongfu’s broad exposure is more attractive than its competitors like Wahaha, Ganten and CRB which are mainly concentrated in bottled water.

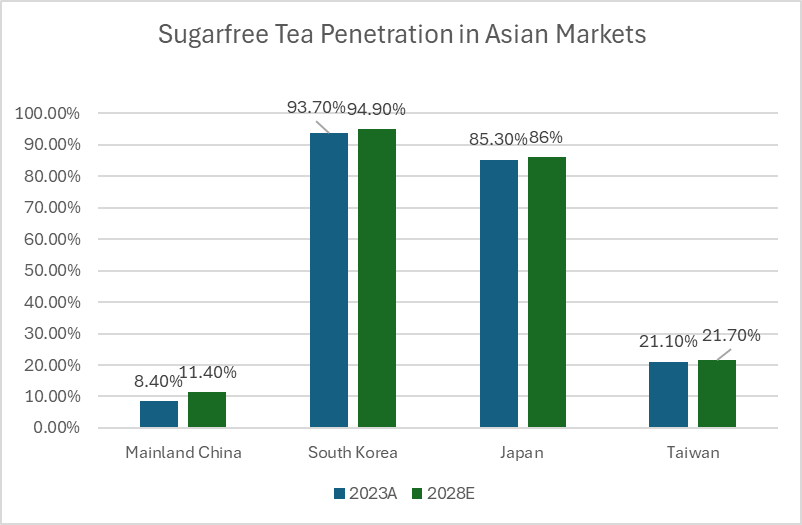

Source: Euromonitor

Nongfu also has optimal exposure to a fast-growing sub-category of RTD tea, the sugar-free category, that has low penetration in China compared to other RTD tea markets with tea culture like Japan as seen above. Sugar-free RTD tea is expected to grow at 15% CAGR to 2030, twice as much as RTD tea.

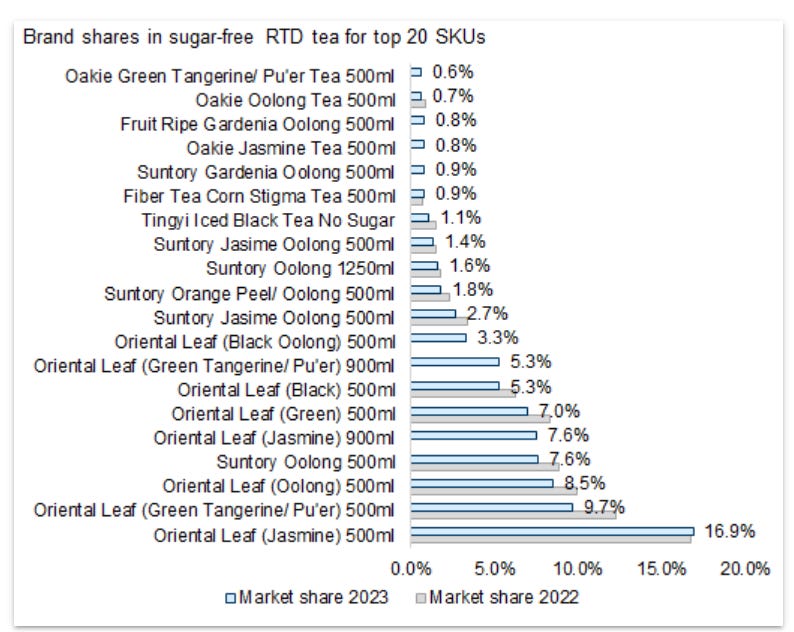

While competition has intensified in RTD tea and RTD sugar-free tea, Nongfu’s brands still have the strongest market share positions.

Source: Goldman Sachs

In the first half of 2024, Nongfu’s main tea brand Oriental Leaf continued to gain share from peers despite the competition.

Source: Goldman Sachs

Furthermore, I believe that Nongfu’s launch into purified water which was previously discussed will have positive spillover effects on its market positioning in tea. When Nongfu launched its purified water product, competitors in purified water had to immediately play defence. At present, other competitors are not as exposed to such a wide variety of categories and Nongfu wants to continue to consolidate their market share in tea and prevent competitors from entering. Hence, with Nongfu’s moat of its proprietary tea technology, I also conservatively project Nongfu’s Tea business to grow slightly ahead of consensus for the next 10 years.

As for Juices and Energy drinks, they are smaller businesses accounting for about 10% of total revenues each, they create optionality for the business. The tea business was actually started in 2011 when the water business experienced some struggles, and the CEO wants to replicate this by creating future optionality in other categories. While their positioning in the energy drink space might not be as strong, if there is a trend that takes off, they are well positioned enough to benefit from the overall tailwind.

Section 3: Valuation and key valuation assumptions:

I break down Nongfu into its respective segments to project Revenues and Gross Profits. The different scenarios are based on speed of recovery and market share gains.

Projecting water revenue:

In 2025, based on recent market share recoveries, consensus sees 14% revenue growth, lapping easy comps as the business regains market share. Based on the past trend, most of Nongfu’s top-line growth is driven by volumes rather than pricing. Hence, the 14% revenue growth is largely attributed to volumes. I estimate that around 5-6% of this volume growth is driven by Nongfu regaining market share, as the market share losses that nongfu experienced at the peak of the scandal, which is around 6-8%. In addition, as Nongfu’s past volume growth trends in a steady market share environment are around 8-9%, which is tied more to overall industry volume growth figures, we can assume the extra 5-6% is from regaining market share.

As mentioned, consensus expectations for top-line growth of the water business after recovery reflect a more mature, consolidated market and growth reverting closer towards industry averages. However, I estimate that extra market share gains will result in 200-300 bps of extra revenue growth in the water space, as I predict Nongfu will hit 30% market share in the next 5 years.

Tea, Juice, Functional, and Other Revenue:

For Tea Revenue, I predict growth that is above consensus due to the strong tailwinds of the industry, especially in RTD Sugar-Free tea. Consensus predicts a slowdown in revenues after 5 years, but I predict 100-150 BPS additional growth in my base case after year 5. With Nongfu’s competitive advantage, most of the industry’s gains will be captured by Nongfu. For the rest of the segments, I am in line with consensus figures with no differentiated view.

Margins:

Despite the strong contraction in revenues due to water’s decline, management was able to implement cost control measures well, and net income margin came in above consensus expectations. Therefore, I expect that margins will return closer to historical averages once growth resumes, simply as a result of operating leverage. Therefore, my more optimistic margin projections for water and tea simply reflect the additional operating leverage from my higher revenue projections in those segments. For the segments of Juice, functional and Other, I follow consensus. Gross profit margin is broken down by segment as production of water, tea, juices and energy drinks have slightly differing cost inputs.

Projections of SG&A costs are done at the group level as most overheads such as marketing, logistics and staffing costs share largely similar cost structures. I project some levels of operating leverage in line with consensus for SG&A, but most of the margin expansion will come from increased economies of scale at the gross margin level.

Working Capital, Capex and D&A:

Consensus projects capex to be slightly elevated in line with consensus as the company seeks to expand in the next few years (2024 annual results p32), but eventually fall to more normalised levels. However, I feel that consensus projections of capex are possibly a bit too optimistic in expecting capex to fall below 10% as a percentage of sales. This is because I expect Nongfu to continually invest for optionality and to fend off competition, hence I use averages, which keep capex/sales at above 10%. D&A also falls in line with averages. As the company is growing its asset base, capex will exceed D&A throughout the projection period.

Working capital projections are based on historical averages. They capture the most important element, the normalisation of inventory levels as distributors destock the excess inventory built up by Nongfu’s price war with the purified green water product.

Intrinsic Value of Nongfu Shanquan:

Based on the assumptions above, these are the different intrinsic valuations I arrive at using the Terminal Growth Rate method, at a 10% WACC and 2% terminal growth rate. The base case gives a valuation of HKD 63.13 and 74% upside, and the range of upside is 12% in the bear case and 113% in the bull case.

DCF valuation and upside based on closing share price on 15/4/2025

I chose a 10% WACC to reflect conservatism as my WACC calculation came up with a very low WACC of 4%, driven by Nongfu’s very low beta of 0.47. I have also inserted a sensitivity table to get a better sense of the share price at a range of different WACCs.

Sensitivity table from base case

Section 4: Management and Capital Allocation:

Nongfu Spring is currently run by Mr Zhong Shan Shan, an owner-operator with strong skin in the game. Mr Zhong has a direct interest in about 84% of the company. I believe Mr Zhong is well aligned with shareholders as he gains the most from the appreciation of the company’s share price, earning a 2 million RMB salary in 2023, and an additional 1.5 million RMB from the Employee stock incentive plan. This is small both compared to the profits of the overall business and Mr Zhong’s net worth. Mr Zhong also signalled further confidence in the prospects of his business and alignment with shareholders when he bought shares from the open market through Yang Sheng Tang, buying 7000,000 shares of the open market in July. Around July share price levels, this amounts to c.231 million HKD. Mr Zhong indicates he plans to purchase up to 2 billion HKD of shares in the press release in August, which indicates further confidence on his end. Based on a rough estimate, this would amount to an additional 53 million shares.

I also believe that Mr Zhong has certain characteristics that benefit Nongfu’s recovery as well. Being a journalist has helped him navigate the current scandal effectively, as he waited for the dust to settle before appearing on national television interviews to change the narrative in his favour.

On the other hand, corporate culture is less than favourable. The industry insider mentioned that Nongfu has the best talent from attracting experienced hires with the best experience, with virtually no internal development program. In addition, the culture is also very cutthroat and the different divisions vie for the CEO’s favour.

Capital allocation:

Management has also been astute with managing the balance sheet. The company has a net cash position of 17.36 Billion RMB. The company also has eschewed large acquisitions and instead invests in its organic growth.

Source: Company Financials, author calculations

My main gripe is the dividend payout ratio, which is high at about 70% for a company that should be reinvested into the business because of bright growth prospects in each of its markets.

Section 5: Risks

Product risk:

There is a loss of demand for natural spring water, making it hard for Nongfu to pivot from its reliance on its spring water sources. This should largely be mitigated by bottled water drinks having long product life cycles compared to other categories. In addition, Nongfu is well diversified in other categories even in the worst-case scenario. The last year provides a good perspective on this diversification, as the fall in water revenue this year of 21% only resulted in net profit being flat.

Reputational risk:

Nongfu can see their business affected by scandals like the one that happened last year. One reputational risk that I can see is regarding the CEO’s son, who holds an American passport through dual citizenship. This can possibly lead to further controversy that a very valuable Chinese company is owned by an American. I believe that just like with the recent scandal in 2024, Nongfu can quickly recover, provided that the reputation damage is not based on product safety. To avoid product safety mishaps that can affect its reputation, Nongfu maintains strict standards on quality control throughout its entire supply chain, with specialised quality control staff, information traceability, distributor monitoring, use of automation to reduce human error in production, distributor monitoring and a product recall mechanism.

Increase in price of raw inputs:

Raw inputs like plastic are a key cost component, and increases in the prices of these raw materials can affect profits. Nongfu protects itself against fluctuations in the price of commodities like PET through the strong relationship with suppliers mentioned above, but also by price hedging for these commodities, and by purchasing larger quantities of such raw materials when prices fall for reserving.

Key man risk:

The company has been led by CEO Mr Zhong who is responsible for most of the decisions that brought Nongfu success. This key man risk is hard to mitigate as the capabilities of his son are hard to ascertain. According to our industry insider, the son is currently in charge of distribution on a provincial level and will move on to be in charge of distribution covering multiple provinces, before succeeding his father. The key mitigant to the succession risk is that once Mr Zhong Shu Zi takes over, the company will operate under a more decentralised management structure. This is because unlike his Father, who is involved in every facet of the business to where every key agenda in each of the different departments is set by him, the son will be most involved in distribution, but other key parts of the business such as supply chain and manufacturing will remain under the oversight of experienced managers that worked under his Father. This is mainly due to the succession timeline, his son will not have enough time to learn about these other parts of the business and take over in the next 3-5 years.