Vestis Spin-Off

Summary:

Vestis, a recent spinoff of Aramark holdings, operates in an attractive industry with strong opportunities to earn high returns on incremental capital. The market appreciates this industry and has awarded premium valuations to Vestis’ peers Cintas and Unifirst. However, Vestis does not benefit from this due to being a recent spin-off that is highly leveraged. As Vestis pays down the debt and successfully executes its cross-selling strategy, there is a possible re-rating of Vestis Stock. Post re-rating, the business can be attractive to hold as it operates in a fragmented industry with the opportunity to earn high returns on incremental capital through consolidation.

Company Overview:

Vestis is the uniform rental services company that has recently been spun out of Aramark Holdings. Vestis makes money by renting uniforms to a wide range of customers and providing cleaning services for those uniforms. Depending on the arrangement with their customers, a Vestis Vehicle will drop off new uniforms every week (or every day in the case of some of their larger customers) and pick up dirty uniforms to clean them. They also provide other services including towel and apron cleaning, first aid supplies and restroom supplies.

Attractive Industry Dynamics:

This industry has several attractive characteristics. Firstly, it is extremely fragmented.

The top 3 players in the industry, of which Vestis is the second, collectively own 15% market share. The rest of the market are small mom-and-pop businesses. Compared to the top 3 market leaders, they do not benefit from Economies of Scale. Vestis and the other larger players benefit from Route density. The same vehicle can pick up and drop off more uniforms than their smaller competitors. These similar scale benefits are enjoyed when it comes to uniform factories and laundry facilities. The market’s appreciation of this industry can be seen in the difference in the premium valuation awarded to Vestis’ peers, including market leader Cintas, who trades at a 35x PE.

In contrast, Vestis is underpriced due to its huge debt burden, which has been incurred by the spin-off. At current rates, Vestis is set to incur around 110 million in interest payments per annum. Vestis has generated 217 million of operating income in 2022, which means an interest coverage ratio of just around 50%. In 2020 and 2021, when the business struggled during Covid 19, While leverage here is uncomfortable for most companies, I still think Vestis is worth looking at because they are operating in an industry with a high level of certainty that is hard to mess up. In the case of an economic downturn, here is why I think Vestis might do just fine. For one, the business has a very well-diversified base of customers. Recession will definitely cause some of these businesses to shut down and not be able to fulfil contractual payments, but Vestis has over 300,000 customers of varying sizes.

Secondly, payments to Vestis are contractual and recurring in nature (92% recurring revenue), so in the event of a recession, Vestis will still receive a steady stream of cash flows. Lastly, uniform services are an essential part of business operations that do not take up a large portion of an overall business expense. This means that Vestis’ customers are not likely to cut their spending on these services, they go belly-up.

Vestis cited that uniform cleaning expenses take up less than 1% of business expenses for most of their clients, meaning that the likelihood of uniform cleaning expenditures being cut in a recession is low.

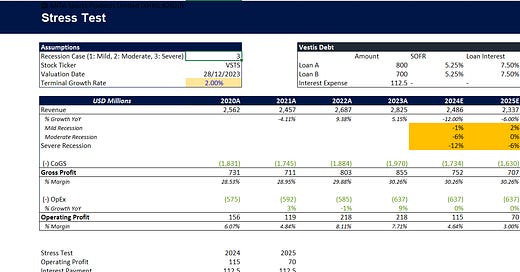

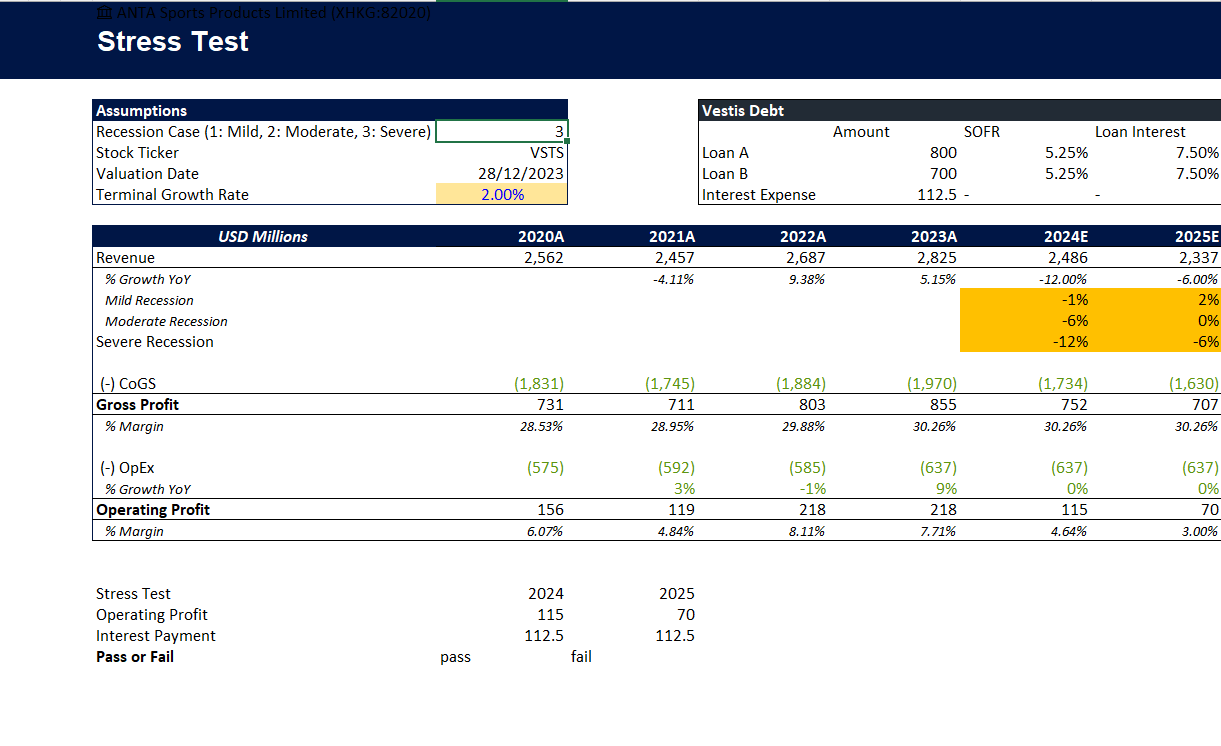

Stress Testing Vestis

While the first thesis suggests that Vestis will be able to generate enough operating income to cover interest payments, with the kind of leverage Vestis has at 4x Debt to EBITDA,

I believe that it is appropriate to perform a stress test and see the type of conditions which would cause a default. In a deep recessionary scenario, I am anticipating a rate cut of 50-75 basis points, which means Vestis’ interest payments on its loans would go down to 67.5 Million. In that case, let's figure out what kind of revenue contraction it would take to cause operating cash flow to go down to 67.5 million. If operating income shrinks to 67.5 million in either 2024 or 2025, I will make the projection of no change in operating expenses as compared to 2023. This will mean that the effect of operating deleverage will be considered, making the stress test even more harsh.

Let’s stress test Vestis’ financials and take a look if they will miss their interest payments in a potential worst-case scenario where a recession causes many of their customers' businesses, especially SMEs, to shut down. During the Covid-19 lockdown period from mid-2020 to mid-2021, when Vestis was still under Aramark, sales revenue fell on average 9-12% quarterly. When I looked at the figures for industry peers, this number was similar. Going all the way back to the 2008 financial crisis, these numbers are once again pretty similar.

In these types of situations, it is also important to consider operating deleverage. Looking at past financials for Vestis and its industry peers during the 2008 recession and the 2020 COVID crisis, operating expenses stayed flat while revenues fell. This resulted in operating deleverage during this period, which in turn resulted in shrinking margins and operating profit. Therefore, it is important to determine in a situation of falling revenues and operating deleverage, how vulnerable will Vestis be. Let’s take a look at this in the stress test that I came up with.

Summary:

Vestis, a recent spinoff of Aramark holdings, operates in an attractive industry with strong opportunities to earn high returns on incremental capital. The market appreciates this industry and has awarded premium valuations to Vestis’ peers Cintas and Unifirst. However, Vestis does not benefit from this due to being a recent spin off that is highly leveraged. As Vestis pays down the debt and successfully executes on its cross-selling strategy, there is a possible re-rating of Vestis Stock. Post re-rating, the business can be attractive to hold as it operates in a fragmented industry with the opportunity to earn high returns on incremental capital through consolidation.

Company Overview:

Vestis is the uniform rental services company that has recently been spun out of Aramark Holdings. Vestis makes money by renting uniforms to a wide range of customers, and providing cleaning services for those uniforms. Depending on the arrangement with their customers, a Vestis Vehicle will drop off new uniforms every week (or every day in the case of some of their larger customers) and pick up dirty uniforms to clean them. They also provide other services including towel and apron cleaning, first aid supplies and rest room.

Attractive Industry Dynamics:

This industry has several attractive characteristics. Firstly, it is extremely fragmented.

The top 3 players in the industry, of which Vestis is the second, collectively own 15% market share. The rest of the market are small mom and pop businesses. Compared to the top 3 market leaders, they do not benefit from Economies of Scale. Vestis and the other larger players benefit from Route density. The same vehicle can pick up and drop off more uniforms than their smaller competitors. This similar scale benefits are enjoyed when it comes to uniform factories and laundry facilities. The market’s appreciation of this industry can be seen in the difference in the premium valuation awarded to Vestis’ peers, including market leader Cintas, who trades at a 35x PE.

In contrast, Vestis is underpriced due to its huge debt burden, which has been incurred by the spin-off. At current rates, Vestis is set to incur around 110 million in interest payments per annum. Vestis has generated 217 million of operating income in 2022, which means an interest coverage ratio of just around 50%. In 2020 and 2021, when the business struggled during Covid 19, While leverage here is uncomfortable for most companies, I still think Vestis is worth looking at because they are operating in an industry with a high level of certainty that is hard to mess up. In the case of an economic downturn, here is why I think Vestis might do just fine. For one, the business has a very well-diversified base of customers. Recession will definitely cause some of these businesses to shut down and not be able to fulfill contractual payments, but Vestis has over 300,000 customers of varying sizes.

Secondly, payments to Vestis are contractual and recurring in nature (92% recurring revenue), so in the event of a recession, Vestis will still receive a steady stream of cash flows. Lastly, uniform services are an essential part of business operations that do not take up a large portion of an overall business expense. This means that Vestis’ customers are not likely to cut their spending on these services, they go belly-up.

Vestis cited that uniform cleaning expenses take up less than 1% of business expenses for most of their clients, meaning that the likelihood of uniform cleaning expenditures being cut in a recession is low.

Stress Testing Vestis

While the first thesis suggests that Vestis will be able to generate enough operating income to cover interest payments, with the kind of leverage does Vestis have at 4x Debt to Ebitda,

I believe that it is appropriate to perform a stress test and see the type of conditions which would cause a default. In a deep recessionary scenario, I am anticipating a rate cut of 50-75 basis points, which means Vestis’ interest payments on its loans would go down to 67.5 Million. In that case, let's figure out what kind of revenue contraction it would take to cause operating cash flow to go down to 67.5 million. If operating income shrinks to 67.5 million in either 2024 or 2025, I will make the projection of no change in operating expenses as compared to 2023. This will mean that the effect of operating deleverage will be considered, making the stress test even more harsh. Let’s take a look at what this will look like in the model below.

Let’s stress test Vestis’ financials and take a look if they will miss their interest payments in a potential worst case scenario where a recession causes many of their customers' businesses, especially SMEs, to shut down. During the Covid 19 lockdown period from mid 2020 to mid 2021, when Vestis was still under Aramark, sales revenue fell on average 9-12% quarterly. When I looked at the figures for industry peers, this number was similar. Going all the way back to the 2008 financial crisis, these numbers are once again pretty similar.

In these types of situations, it is also important to consider operating deleverage. Looking at past financials for Vestis and its industry peers during the 2008 recession and the 2020 covid crisis, operating expenses stayed flat while revenues fell. This resulted in operating deleverage during this period, which in turn resulted in shrinking margins and operating profit. Therefore, it is important to determine in a situation of falling revenues and operating deleverage, how vulnerable will Vestis be? Let’s take a look at this in the stress test that I came up with.

In our worst recession case scenario, assuming interest rates remain the same, Vestis fails to meet their interest payments in 2025. Even if rates are cut lower by 75 BPS, bringing Vestis’ interest payments down to 86.5 million annually , the test still does not pass this worst case scenario, as it will miss its interest payment in 2025.

Financial Model

The stress test above has already put me off into investing in Vestis, but I am going to model what I think a bull case will look like for the company.

The model above looks first at a best case scenario, where Vestis can successfully execute. I model both gross and operating margins to expand by 1% per year. At this level of margin expansion, by the last forecast year of 2029, gross and operating margins will be at 35% and 13% respectively, still below that of Cintas, the market leader, which has 45% gross margin and 16% operating margin. As the 2nd largest player in the industry, Vestis certainly has the scale required to reach those margin levels, so I do not think those projections are unrealistic.

In this scenario, Vestis can generate decent amounts of free cash flow. However, we must keep in mind the 112 million of annual interest payments, and the further commitment by the management to pay down debt and reduce leverage to 2x from its current levels of around 4x. If that were to be the case, almost half of free cash flow will be directed to interest payments and paying down debt, leaving the rest as ‘owner’ free cash flow. I have attempted to model that scenario below. If half of free cash flow goes to interest payment and debt pay down annually, I do get a Debt to Ebitda ratio of around 2.2x, which is in line with management targets. In this case, the downside is 50% from today’s price, which is an intrinsic value of $10.56.

While there is a possibility that interest payments can be reduced after 2025 after the first 700 million loan is refinanced at a lower interest rate, I cannot be sure what the refinancing rate would be. If Vestis does execute well and interest rates are cut by then, their interest payments can definitely be reduced.

Conclusion:

I initially was attracted to Vestis, given the attractive dynamics of the spin off. However, at half of the company’s market cap, the leverage is far too much. In the worst case scenario, this leverage is high enough where it could cause the company to miss interest payments in a recession scenario, resulting in possible dilution if capital needs to be raised, and the stock’s multiple being further compressed. On the other hand, even if the company executes successfully and is able to expand their margins while growing at rates similar to industry leader Cintas, large amounts of its free cash flow will be eaten up by interest payments. The risk reward is not attractive here, and there are more attractive opportunities when it comes to spin offs.

In our worst recession case scenario, assuming interest rates remain the same, Vestis fails to meet its interest payments in 2025. Even if rates are cut lower by 75 BPS, bringing Vestis’ interest payments down to 86.5 million annually, the test still does not pass this worst-case scenario, as it will miss its interest payment in 2025.

Financial Model

The stress test above has already put me off from investing in Vestis, but I am going to model what I think a bull case will look like for the company.

The model above looks first at a best-case scenario, where Vestis can successfully execute. I model both gross and operating margins to expand by 1% per year. At this level of margin expansion, by the last forecast year of 2029, gross and operating margins will be at 35% and 13% respectively, still below that of Cintas, the market leader, which has 45% gross margin and 16% operating margin. As the 2nd largest player in the industry, Vestis certainly has the scale required to reach those margin levels, so I do not think those projections are unrealistic.

In this scenario, Vestis can generate decent amounts of free cash flow. However, we must keep in mind the 112 million annual interest payments, and the further commitment by the management to pay down debt and reduce leverage to 2x from its current levels of around 4x. If that were to be the case, almost half of free cash flow would be directed to interest payments and paying down debt, leaving the rest as ‘owner’ free cash flow. I have attempted to model that scenario below. If half of free cash flow goes to interest payment and debt pay down annually, I do get a Debt to Ebitda ratio of around 2.2x, which is in line with management targets. In this case, the downside is 50% from today’s price, which is an intrinsic value of $10.56.

While there is a possibility that interest payments can be reduced after 2025 after the first 700 million loan is refinanced at a lower interest rate, I cannot be sure what the refinancing rate would be. If Vestis does execute well and interest rates are cut by then, their interest payments can definitely be reduced.

Conclusion:

I initially was attracted to Vestis, given the attractive dynamics of the spin-off. However, at half of the company’s market cap, the leverage is far too much. In the worst-case scenario, this leverage is high enough that it could cause the company to miss interest payments in a recession scenario, resulting in possible dilution if capital needs to be raised, and the stock’s multiple being further compressed. On the other hand, even if the company executes successfully and is able to expand its margins while growing at rates similar to industry leader Cintas, large amounts of its free cash flow will be eaten up by interest payments. The risk-reward is not attractive here, and there are more attractive opportunities when it comes to spin-offs.